japan corporate tax rate 2020

This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1.

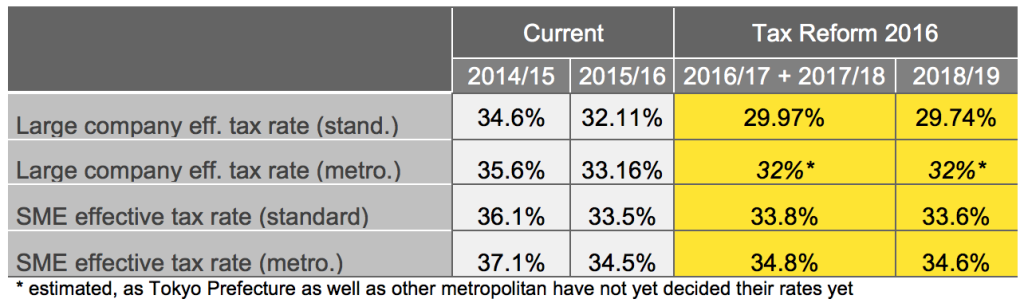

Japan Tax Reform 2016 Japan Industry News

Japan corporate tax rate 2020.

. Taxable income over 10 million. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan averaged 4083 percent from.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Corporate Tax Rate in Japan averaged 4083 percent from. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of.

Japan corporate tax rate 2020. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with. The corporate tax rate in Japan for a branch is the same as for a subsidiary. 13 February 2020 Japan tax newsletter Ernst Young Tax Co.

Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. What is Corporate Tax Rate in Japan.

Corporate - Group taxation. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief. 2020 Japan tax reform outline. The Corporate Tax Rate in Japan stands at 3062 percent.

推薦指數 30 10. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any. The maximum rate was 524 and minimum was 3062.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. GIG is a specialist group established to respond to the. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a.

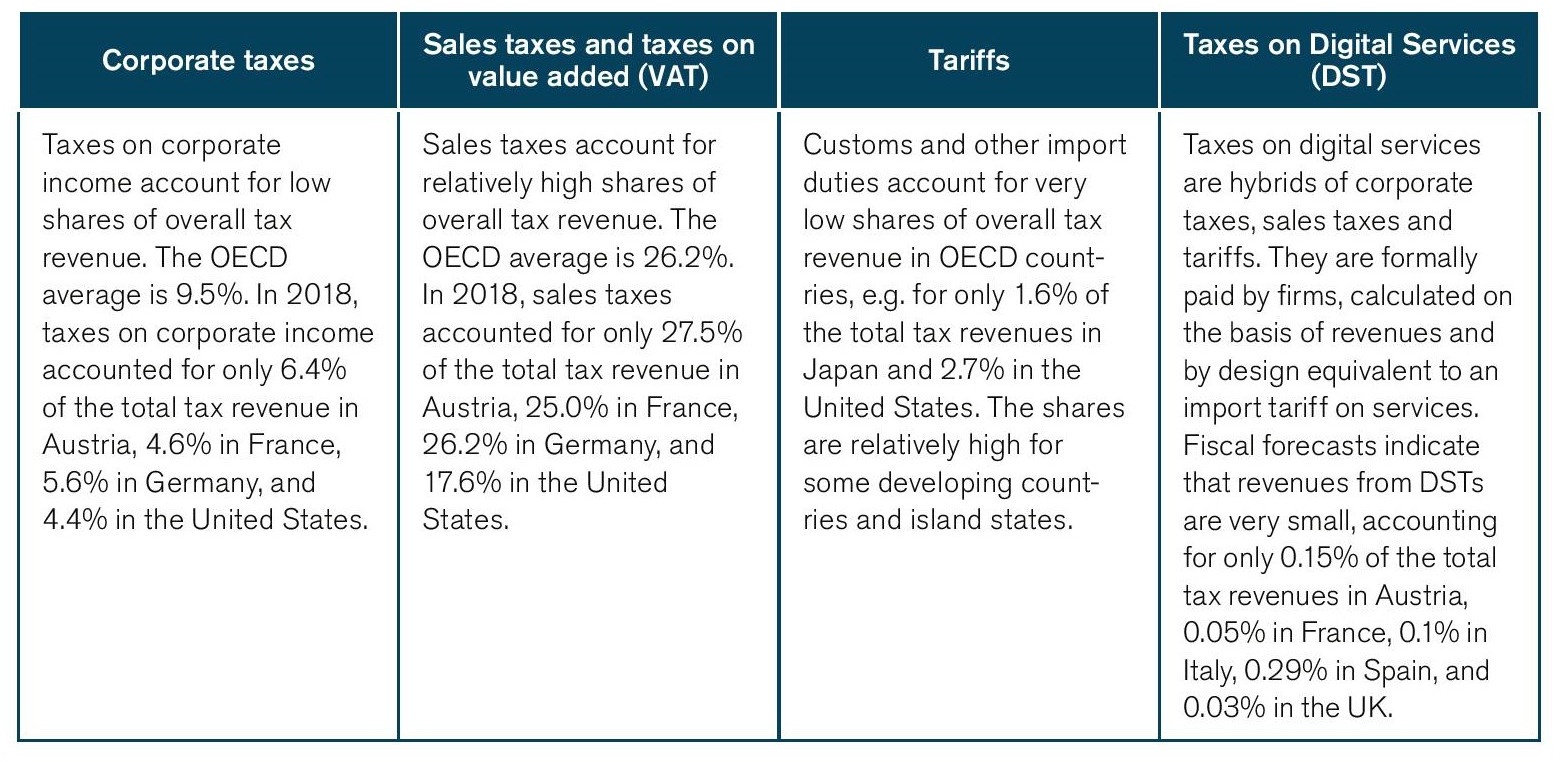

Corporate Tax Rate Pros And Cons Should It Be Raised

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

A Quick Guide To Taxes In Japan Gaijinpot

Corporation Tax Europe 2021 Statista

Japan S Kan Seeks Corporate Tax Cut Wsj

Charles Schwab Market Commentary Global Impact Of A Blue Wave Election Outcome

Did Ireland S 12 5 Percent Corporate Tax Rate Create The Celtic Tiger Tax Justice Network

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Tax Foundation President Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top Integrated Tax

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

Around The World Covid 19 Prompts New Look At Company Taxes Fm

Corporate Tax Rates Around The World Tax Foundation

Japan Corporate Tax Rate 2022 Take Profit Org

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

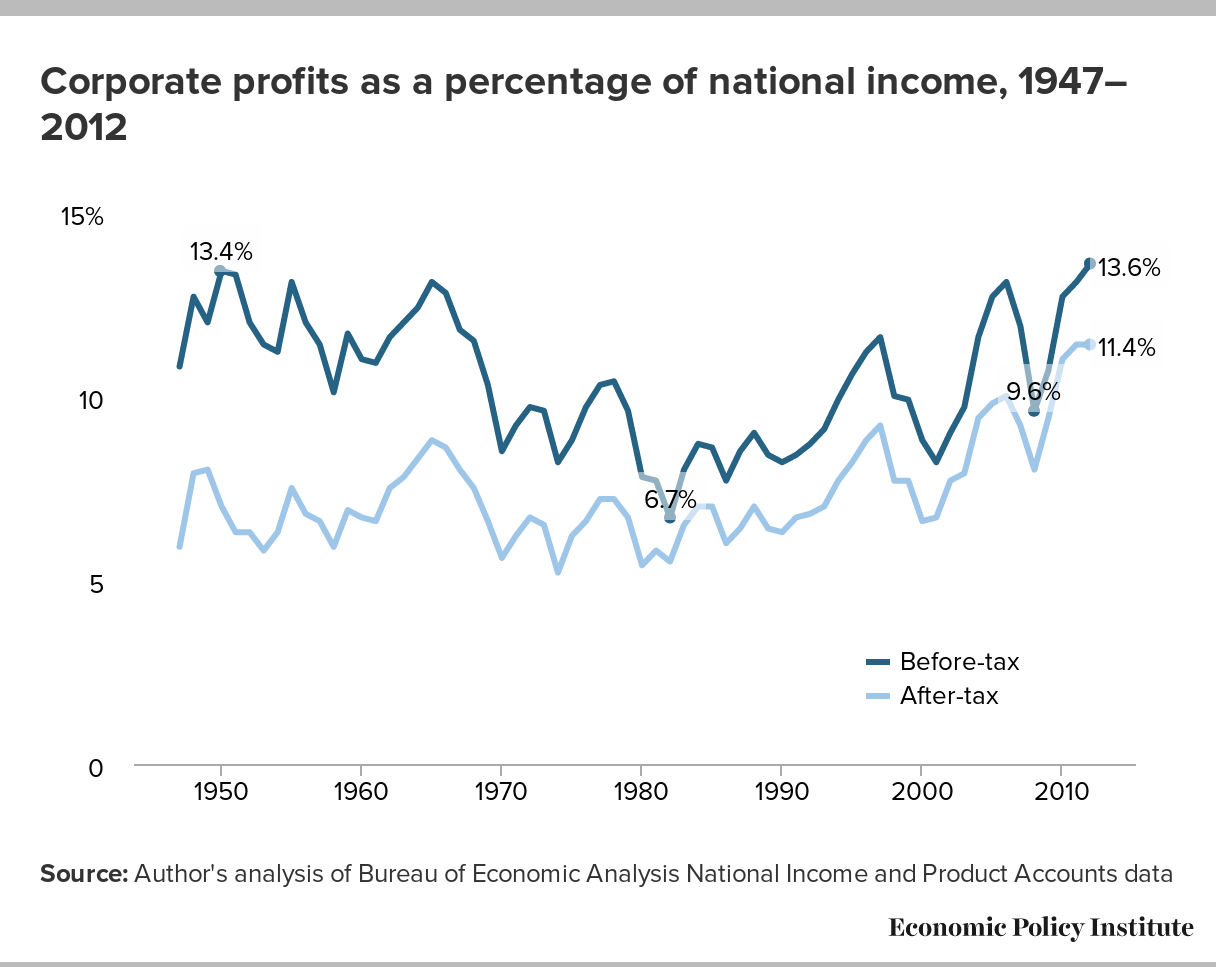

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

What Every Foreigner Working In Japan Should Know About Resident Tax Tsunagu Local

Corporate Tax Rates Around The World Tax Foundation

Pdf A Comparison Of Corporate Tax Rates In Selected Asian Countries 1980 2020 Robert Mcgee Academia Edu

Japan Corporate Income Tax Filing Services Bilingual Tax Accountant